expat network

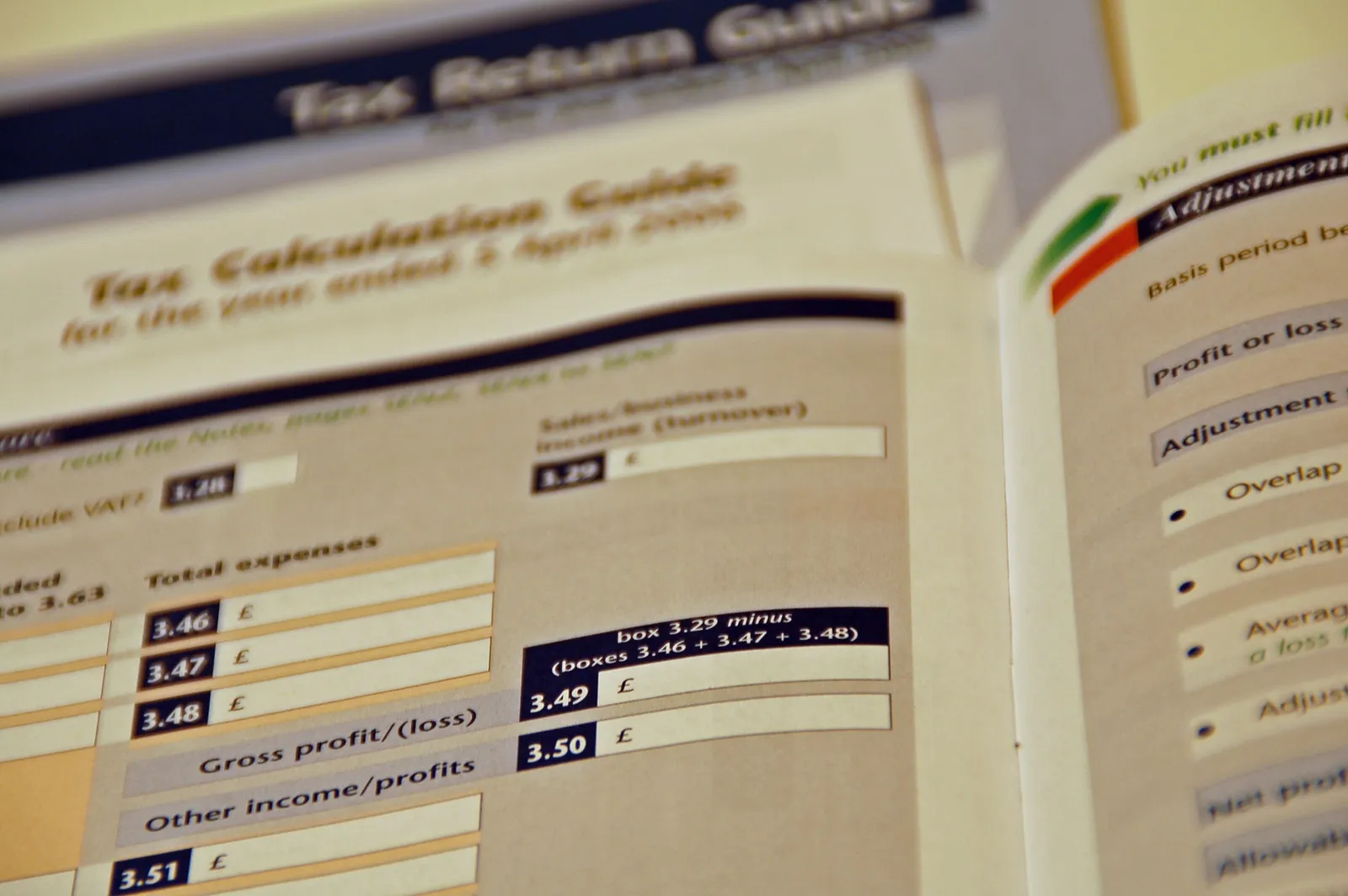

Moving to Portugal – Money

So, you are moving to Portugal!

So you are moving to Portugal! Make the transition work better with this free-to-download, full-colour guide. Your Guide To Living In Portugal provides you with guidance on the issues you will need to address as you plan your move, whether that is to retire, buy a second property or simply enjoy a whole new life.