Do I Need To Complete The UK Self Assessment?

If you are classed as self-employed or have a source of untaxed income, you will be required to complete a Self Assessment. However, this criteria is vague and many are left confused as to whether they actually need to file the tax return or not. Written exclusively for Expat Network by Mike Parks of GoSimpleTax...

A Guide To Record-Keeping And Expenses For The Self-Employed

If you’re new to self-employment, record-keeping might sound like hard work – even for those who have been filing for years it can be daunting. While that may be true, it does come with its own reward – namely, that sole traders can claim back allowable expenses and pay less tax on their earnings. Written...

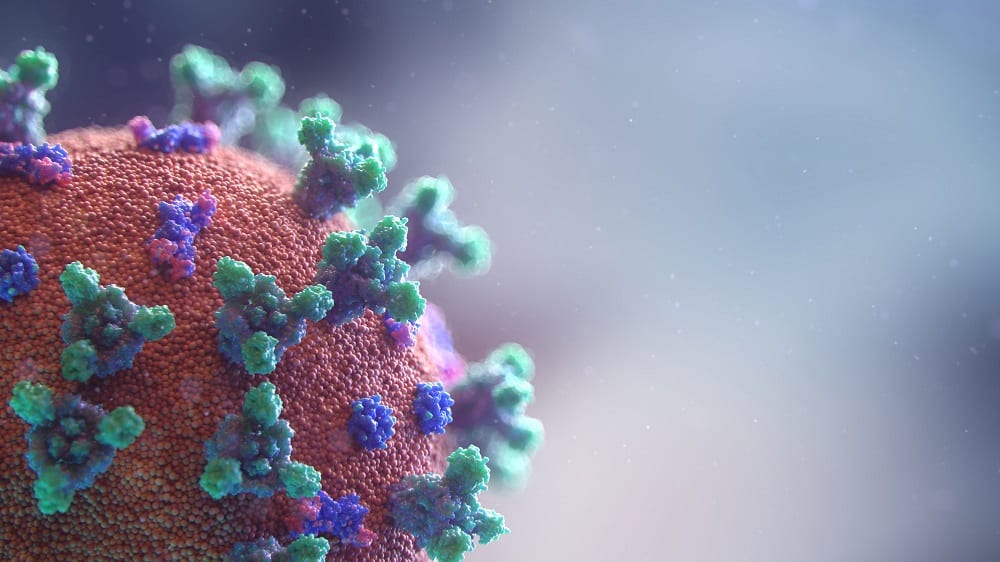

Covid-19 Self-Employed Income Support Scheme In UK

Missed the January self-assessment deadline? You have four weeks to file your 18/19 tax return to enable you to access the government grant announced by Chancellor Rushi Sunak. Written for Expat Network by GoSimpleTax Self-Employed Income Support Scheme Summary: You must have completed your 18/19 tax return 80% of profits up to £2,500 per month...

A Guide To Recent Tax Changes For Landlords

With the latest Budget fresh in everyone’s minds, it’s easy to lose track of the changes actually impacting landlords today. For landlords who don’t have the time to keep abreast of every update to legislation, it’s hard to keep up and remain compliant. That’s why we’ve asked Mike Parkes from GoSimpleTax to weigh in on...

Be Tax Savvy: File Early In 2020

GoSimpleTax recommend that you submit your tax return in April. Filing just short of the deadline can be a dangerous game. HMRC is under pressure, you may not have the documents you need, and it doesn’t leave you much time to save for your tax bill. Filing in April, on the other hand, solves the...